How Do Crypto Markets Work?

Cryptocurrencies have evolved so much over the years that many investors now see them as macro assets such as stocks. However, they are still subject to their own unique circumstances that play a part in their investment value. So, what do investors need to know?

The Crypto Market Cycles

Every investment market has its own rhythm, and in the last decade, we have seen cryptocurrencies go through a four-phase cycle that includes accumulation, expansion, distribution, and correction. The variation in these cycles was due to the fact that Bitcoin’s supply in the market heavily dictated the market’s stability and value. But now that big institutions, such as pension funds, have thrown their hats into the ring and own a majority of the market, the cycle phases have become less drastic as the market is now stable. Even so, you will come across variations over the years, which are as follows:

- Accumulation. This cycle takes place following a market crash. We see two main trends in this case. On one side, you have many investors who are afraid to invest in cryptocurrencies as they have seen the market lose value and do not want to take on the risk. But on the other side, you have investors who use this time to buy the currencies, knowing that the market will recover and they will turn a tidy profit.

- Expansion. As the market recovers, people start paying more attention to it, and the media jumps in with more coverage. Soon enough, more investors start directing their funds into these currencies, and the crypto prices go up steadily.

- Distribution. The crypto prices continue climbing until they get to what we can refer to as the top or height of the market. Long-term investors, as well as investors who have paid attention to the market signals, use this opportunity to sell to new buyers who are entering the market at this time because they are attracted to the high prices. Now is the time when the fear and greed indices are at their highest.

- Correction. As with any market that has witnessed an exponential rise in value, the bubble bursts, and the crypto prices start falling. This decline continues until the prices reach the floor, paving the way for the cycle to start again.

As stated earlier, the market crashes have reduced over the years, such that we are now seeing more of market corrections. But that is not to say that the market is not going through these phases.

Understanding the Volatility in the Market

While the market cycles have changed in terms of their variation and become more stable, there is no denying that cryptocurrencies are still highly volatile. In fact, they are much more volatile than investing in the S&P 500. So, why is this the case?

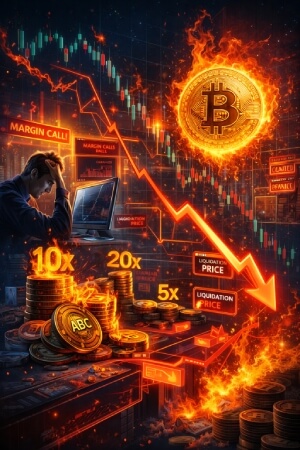

The Role Of Leverage

In the stock market, traders are always ready to wait out price changes because they know that patience pays. But in the crypto market, it is not always that simple, and a small change of 5% can lead to a loss worth millions of dollars. And it all comes down to leverage.

You see, many traders in the crypto market rely on leverage from the exchange. For example, a trader can use 10* leverage when they have $1,000. Essentially, what they would be saying is that they want to bet $10,000 on a price increase on coin ABC such that the exchange gives them the extra $9,000 against their collateral of $1,000. But here is the problem. If the price of the coin drops, by say 10%, then the $10,000 is now worth only $9,000, which means that they have now lost their collateral.

But that is not all. The trade systems are set up in a way to prevent exchanges from losing the money they lend to their traders, so they automatically sell the traders’ coins the minute that they reach the liquidation price, which again, is not always to the benefit of the trader. What’s more, traders do not have a say on this as it is an automatic process.

To make matters even more complex, cascades can also take place amidst all this because liquidations are subject to a wide range of other factors that affect multiple traders at once. Here is how this works. First, we have the trigger that results in a price drop, which can be anything from bad news to just overall fear in the market. Then, this price drop results in the hitting of the liquidation price, which, as we explained, prompts the exchange to sell the positions meeting these criteria, which often affects traders with very high leverage. After this, we have the momentum because once forced sales take place, the market takes on this added pressure and, as you can imagine, these stats do not augur well with trust in the market. So, this causes another price drop, which again affects people who had taken on a leverage that puts them at the new liquidation price. This cycle can continue over and over, and has been known to wipe out trading positions in a matter of hours. The exact thing happened in October 2025, where traders lost almost $20 billion in positions because the systems were set up to force sales to cover people’s debts.

The Market Depth

When you see coins like Bitcoin boasting a market cap of over $2 trillion, it is easy to think that the crypto market is stable. However, this is not quite the case, as this market cap does not reflect the actual market depth. In reality, the crypto market is still in its developmental stages, such that one big change is enough to affect every other investor. How so?

Let’s use the S&P as our reference point. This market has so many players holding so many investments that even the actions of a big player would barely affect the others. Take the example of a billionaire who decides to sell all their holdings. As much as this would affect the individual companies and anyone with a particular interest in them, it would not affect the market as a whole much. In fact, many traders would be able to continue with their operations as if the sale never happened. But with the crypto market, big players have a substantial effect. If a big player, for example, decides to sell $500 million of their crypto, they often do this through a process known as slippage. How? First, they sell the first portion of their assets to people who are waiting to buy their crypto at the current price. Then, they move on to the next set of buyers who are willing to buy their assets at a lower price. They keep doing this in a way that lowers the prices with consequent sales. And while you might think that this technically just affects them, they will have driven overall market prices down by the time they complete the sales. For example, if they started selling at $80,000, the prices may have gone down to $77,000 by the time they finish, and this is all because one player decided to exit the market.

As long as the crypto market remains fragmented, i.e., the money is not all in one place, big players will continue having an effect on the overall market, unlike in the S&P, where buyers and sellers can enter and exit the market without causing significant changes for the other players.

Do Macro Factors Play a Part in the Crypto Market?

Like any other market, crypto is subject to the influence of political, economic, social, technological, environmental, and legal factors. Most notably, it changes based on the following factors:

- The prevailing interest rates. When the interest rates go down, investors feel more comfortable with moving their money into assets they consider risky, and crypto wins in this regard. However, when the interest rates go up, as they often do when governments are trying to combat inflation, then investors become more attracted to safer assets such as government bonds.

- The attitudes towards fiat currencies. Cryptocurrencies have always been attractive to people who appreciate their decentralization aspect. It thus follows that when people have less faith or even lose faith in fiat currencies, then they turn to crypto as their solution. It could be for reasons such as inflation or even high deficits, but no matter the case, crypto serves as a better alternative. As such, it is quite possible to see major shifts in attitudes where people may shun crypto for its perceived high risk on one day and then embrace it as a more trustworthy currency the next day.

It also helps to note that positive social attitudes in the past few years have also played a part in the growth of this market, as more people have opened up to the idea of alternative investments.

Market Signals That All Investors Should Know

We have stated that the crypto market goes through cycles that affect the price of the currencies as well as the willingness of people to invest in them. As an investor, knowing how to read these signals enables you to know what to do at every stage. So, what should you turn your attention to?

- The volume of stablecoins. If you see that the number of stable digital coins, such as USDT and USDC, has increased in the exchanges, you should take this as a sign that people are getting ready to buy crypto. What’s more, it shows you that people have enough money to not only support the price but also push it higher.

- The sentiments. We mentioned the fear and greed indices before. These are scores that range from 0 to 100, which let you know how people are feeling about the market. If they are greedy (75-100), then the prices go up, but when they have reservations (0-25), the prices go down as people sell their assets in panic.

Keeping an eye on these numbers can help you understand the current market cycle so you can make the best investment decision at the time, e.g., waiting until the fear and greed scale is low so you can buy crypto at a lower price.

𝗕𝗹𝗼𝗰𝗸𝗰𝗵𝗮𝗶𝗻 𝗙𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹𝘀 — 𝗛𝗼𝘄 𝗕𝗹𝗼𝗰𝗸𝘀 𝗮𝗻𝗱 𝗖𝗵𝗮𝗶𝗻𝘀 𝗪𝗼𝗿𝗸 𝗦𝗲𝗰𝘂𝗿𝗲𝗹𝘆

— Web3Cryptic (@therealonazi) January 24, 2026

Imagine a 𝗻𝗼𝘁𝗲𝗯𝗼𝗼𝗸 where each 𝗽𝗮𝗴𝗲 is a 𝗯𝗹𝗼𝗰𝗸. Once you write on a 𝗽𝗮𝗴𝗲, it’s sealed with a special code called a 𝗵𝗮𝘀𝗵. Every new 𝗽𝗮𝗴𝗲… pic.twitter.com/WuEqqDJkCc

Token vs Coin — Structure, Power & Risk

— Akshay | $P2P (@AkshayLadumor) January 25, 2026

1️⃣ Meaning

In crypto, the difference between a coin and a token is about who controls the blockchain.

• Coins power a blockchain

• Tokens use a blockchain

This one line explains everything.

2️⃣ Coins = Infrastructure Layer

Coins exist… pic.twitter.com/sdUoB661I1